Would Investors Be Smart To Move Portfolios To Cash Now?

The stock market does not always inspire confidence in regular Americans. You may already be asking yourself, should I just get the heck out of the market entirely? If you already cashed out—perhaps months ago—should you stay out?

Cashing out is a defensive instinct that is easy to understand. Inflation is slowing, but it's still pretty high. Fears of recession are still looming. But in this market or any other, cashing out is not always the smartest way to protect your money.

- Forbes Advisor

- |

- 4/25/2023

- Go To Article

Charles Schwab & Co. will pay $187 million settlement after SEC drops its 'pre-set for business reasons' case

Charles Schwab & Co. is paying the Securities and Exchange Commission (SEC) $187 million - if not officially in penance- for alleged transgressions that put its own interests ahead of its robo clients.

But the trade-off paid off in the sense that Schwab began the practice in 2015 to catch Betterment and Wealthfront and keep pace with Vanguard's discount RIA. Today, it is, by far, the largest retail investing robo-advisor.

- RiaBiz

- |

- 7/6/2022

- Go To Article

Who snagged the best investment results in 2021? Dalbar knows

Buy-and-hold investors in equity index funds, equity value funds and real estate sector funds earned the highest average returns in 2021. Investors in bond funds fared poorly, according to Dalbar's Quantitative Analysis of Investor Behavior (QAIB) for the period ending December 31, 2021.

The average investor has maintained an approximate 70% equity to 30% fixed income allocation since 2017, Dalbar said. Inflation for calendar 2021 was 7.04%. The highlights of the latest QAIB survey are below.

- Retirement Income Journal

- |

- 4/21/2022

- Go To Article

A 5-Year Cushion against Market Risk

Louis S. Harvey, the founder of Dalbar, a kind of J.D. Power for the financial services industry, analyzed stock market history and found that since 1940 US equities have always recovered, even in real terms, within five years of any crash.

He uses that finding-which might surprise a few people-as the basis for a portfolio asset allocation strategy that he's now sharing with the world.

- Retirement Income Journal

- |

- 1/20/2022

- Go To Article

Retirement Plan Enrollment Improves, but Support is Lacking

Like we didn't already have enough hurdles with retirement, a review of plan enrollment experiences found that while participation was up overall, support and guidance during the online process was severely lacking.

Boston-based research firm DALBAR looked at traditional and ''quick'' retirement plan enrollment experiences and found a ''downturn and occasional stagnation'' in the already underwhelming guidance offerings found during online enrollment. They reported a decline in enrollment instructions, answers to frequently asked questions and relevant support for various enrollment tasks. Calling the lack of guidance ''unfortunate,'' the firm noted the already low prevalence of readily available contact methods presented to enrollees.

- 401(k) Specialist

- |

- 1/19/2022

- Go To Article

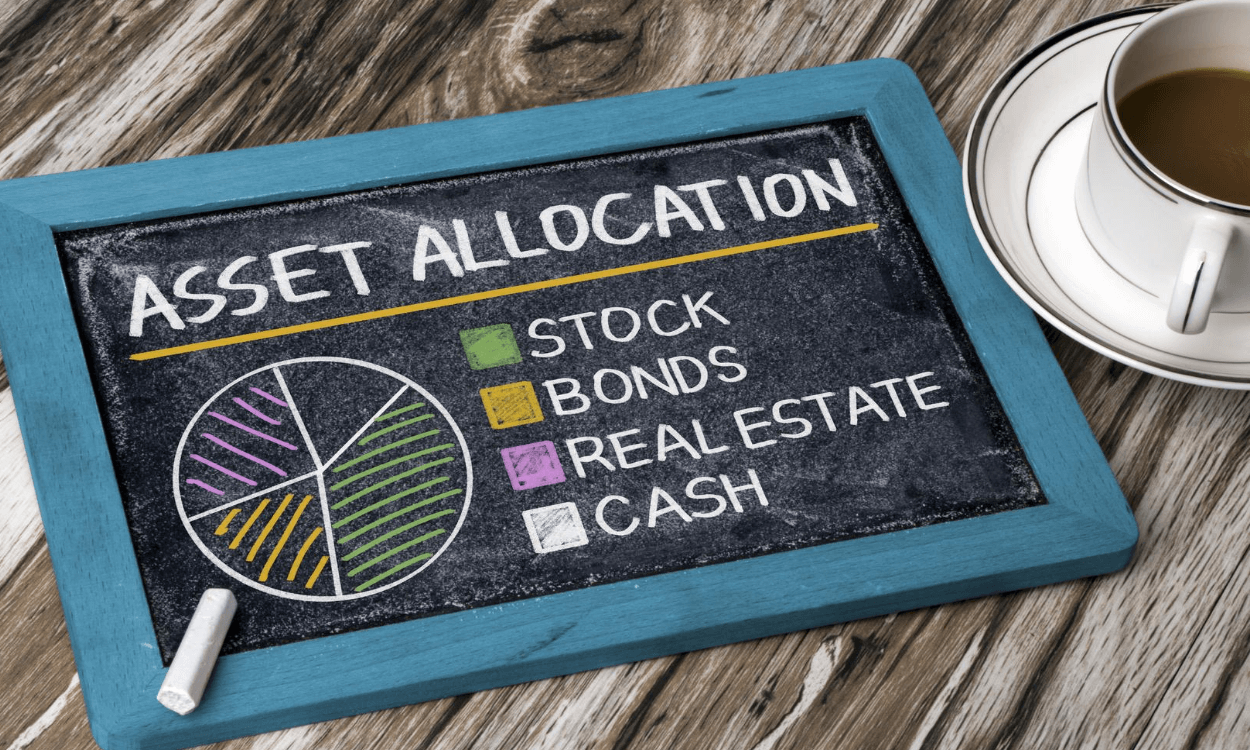

Standard Asset Allocation Models Are Wrong: Dalbar

Financial advisors who allocate client assets based on clients' cash needs for two to three years in the future are making a mistake, according to Dalbar, a financial services research firm.

In a new report, Dalbar founder and president Louis Harvey writes that asset allocations for clients should be based on their cash needs for five years because since 1940 five years was the longest period for the S&P composite index to recover its losses from any downturn.

''This is very seldom done,'' Harvey told ThinkAdvisor, adding that advisors who just focus on asset allocation and don't create financial plans often don't consider clients' cash needs at all.

- ThinkAdvisor

- |

- 1/11/2022

- Go To Article

Study Finds Do-It-Yourselfers Lack Key Retirement Info

Investors who don't know how much they have saved for retirement are less likely to arrive in those proverbial golden years with optimal financial results. But some two and half times more do-it-yourself investors than investors who hire advisors find themselves in that unenviable position, a new study on retirement readiness from Dalbar found.

In fact, some 17.9% of investors who decided to go it alone are in the dark about how much they've accumulated for retirement. In contrast, 7.4% of investors who work with an advisor did not know what their retirement balance is, according to the study, ''Got a Plan: A Study on Advisor Value from the Lens of Retirement.''

- Financial Advisor Magazine

- |

- 10/1/2021

- Go To Article

Retirement Readiness a Guessing Game for Most Investors

A recent study of 1,103 investors found that more than half (53%) had not developed a financial plan to fund their retirement in the last 5 years, and more broadly, found an alarming lack of knowledge among some investors related to their retirement savings.

- 401k Specialist

- |

- 9/30/2021

- Go To Article

Average Equity Investor Lagged S&P 500 By 2% in First Half, Dalbar Finds

The average investor's portfolio lagged the performance of the S&P 500 by more than 2.1 percentage points through June 30, the mid-year Dalbar QAIB report (Quantitative Analysis of Investor Behavior) study released today found.

The average return gap between the average equity fund investor and the U.S. equity market has widened considerably in the first half of 2021—doubling from last year, according to Dalbar, which has studied investor behavior for the past 27 years.

- Financial Advisor Magazine

- |

- 8/25/2021

- Go To Article

The Psychology Behind Your Worst Investment Decisions

When it comes to investing, we have met the enemy, and it's us. Excited by profit and terrified of loss, we let our emotions and minds trick us into making terrible investing decisions. ''As humans, we're wired to act opposite to our interests,'' says Sunit Bhalla, a certified financial planner in Fort Collins, Colo. ''We should be selling high and buying low, but our mind is telling us to buy when things are high and sell when they're going down. It's the classic fear-versus- greed fight we have in our brains.''

- Kiplinger

- |

- 7/22/2021

- Go To Article

The Real Reasons Clients Pay Advisors

The obvious consensus is that the client is convinced that they're better off with the advisor than without! This is the fundamental reason that clients pay their advisor despite the fact that lower-cost or zero-cost alternatives are available.

Being better off with the advisor is not about the advisor; rather, it is all about the client. Having seen volumes of material that describe why a client should use an advisor, I can tell you there is scarcely a note about how to make the client better off.

So how does the advisor make the client better off?

- ThinkAdvisor

- |

- 7/9/2021

- Go To Article

Voya Receives DALBAR ESG Retirement Plan Certification

Voya Financial announced that it has become what it says is the first publicly-traded company to receive an Environmental, Social, and Governance (ESG) Retirement Plan Certification from DALBAR.

Voya received the certification, along with a five-star rating, for the 401k plans offered to its own employees. DALBAR’s ESG Plan Certification is an annual process to evaluate a plan's success in actively applying ESG principles to its retirement plan.

- 401(k) Specialist

- |

- 6/16/2021

- Go To Article

Is your 401(k) ESG? There's a certificate for that

A recently launched pilot program from financial services company auditor Dalbar examines 401(k) plans on their ESG merits.That program, ESG Certification for Retirement Plans, rates 401(k)s with up to five stars and tells plan sponsors what they can do to improve their plans on the basis of environmental, social and governance criteria.

That does not necessarily mean adding ESG-specific mutual funds, ETFs or collective trusts to the investment menu. Rather, Dalbar CEO Lou Harvey said, the most important considerations are how ESG-friendly a plan is in its overall design, administration and participant outcomes. For example, that includes whether plan committees go through reams of paper.

- Investment News

- |

- 6/15/2021

- Go To Article

Voya Receives DALBAR ESG Certification

Voya Financial is the first publicly traded company to receive an Environmental, Social and Governance (ESG) Retirement Plan Certification from DALBAR.

DALBAR's ESG Plan Certification is an annual process to evaluate a plan’s success in actively applying ESG principles to its retirement plan. Voya received the certification, along with a five-star rating, for the 401(k) plans offered to its own employees, according to the June 10 announcement.

- NAPA Net

- |

- 6/14/2021

- Go To Article

Variable Annuities: Winning By Not Surrendering

After all the analysis is done on rates, fees and performance, there is really one key metric that means more than the others - patience.

Great returns don't mean much if investors motivated by emotion or misplaced confidence in their market timing skills jump in and out of funds. When investors jump, those small gaps widen to large gulfs between what they accumulate and what they could have amassed for retirement.

- Insurance News Net

- |

- 6/4/2021

- Go To Article

Un 2020 non fa primavera

I l 2020 è stato un anno di grandi anomalie per l'investitore, dalla pandemia al lockdown, dal crollo dei mercati al velocissimo recupero.

Dalbar, società di consulenza statunitense che a partire dal 1994 redige il Quantitative Analysis of Investor Behavior (QAIB) in cui misura gli effetti delle decisioni (buy, sell, switch tra fondi) degli investitori statunitensi nel breve e nel lungo termine. Nell'edizione annuale la sociatà ha certificato una nuova anomalia rilevata nei suoi studi sul comportamento degli investitori. Una grande freddezza e la capacità di cogliere il momento di panico e di irrazionalità dei mercati per realizzare rendimenti importanti sui mercati finanziari.

- Federated Hermes

- |

- 5/1/2021

- Go To Article

DOL embraces ESG, suspends enforcement of ''Financial Factors'' rule and begins work on a new rule

The Department of Labor (DOL) recently issued a strong statement in favor of ERISA plans selecting prudent investments that consider environmental, social and governance (ESG) factors. Intending to reassure plan fi duciaries and advisors confused by the new ''pecuniary'' and ''non-pecuniary'' tests in the ''Financial Factors in Selecting Plan Investments'' final rule, DOL announced that it suspended enforcement of the Financial Factors rule, and has begun working on a replacement rule.

- Federated Hermes

- |

- 5/1/2021

- Go To Article

DOL Eyes Nuclear Option, Revisits Advisor Rollover Exemptions

The U.S. Department of Labor has indicated it will likely revisit its stance on advisors' fiduciary obligations when they make rollover investment recommendations.

In fact, the DOL is indicating the prohibited transaction exemption called ''Improving Investment Advice for Workers & Retirees,'' or PTE 2020-02, which was approved in February, may be a placeholder while the agency re-examines rollover advice, according to an analysis from Dalbar Inc. The five-part exemption is designed to allow fiduciary advisors to accept commissions and other compensation normally prohibited to them without triggering ERISA violations.

- FA Magazine

- |

- 4/19/2021

- Go To Article

Il gap con il ''robo'' si assottiglia

Le conseguenze della pandemia da Covid19 hanno impattato anche il rapporto tra cliente e consulente finanziario? E come hanno reagito gli investitori alle indicazioni del loro advisor, ''robo'' o ''tradizionale'' (cioè umano)? Domande cui ha provato a rispondere una survey di Dalbar, una delle principali società statunitense di ricerche di mercato sui servizi finanziari. La ricerca ha riguardato circa un migliaio di investitori statunitensi così ripartiti: 500 con un consulente finanziario tradizionale e 495 con un robo advisor.

- Advisor Magazine

- |

- 3/1/2021

- Go To Article

DALBAR Offers Free IRA Rollover Classes For Navigating New DOL Rule

Dalbar and the Retirement Learning Center (RLC) have combined forces to offer advisors two free virtual courses to help them comply with the Department of Labor's ''radical changes in compliance procedures'' for retirement rollovers, which go into effect February 23.

The complimentary courses are being offered concurrently with the go-live date of the DOL's ''Improving Investment Advice for Workers and Retirees Prohibited Transaction Exemption rule (PTE 2020-02)'', which defines a rollover recommendation as a fiduciary act requiring an exemption.

- FA Magazine

- |

- 2/18/2021

- Go To Article

4 Common Mistakes That Could Derail Your Retirement —and How to Avoid Them

This might be the most common mistake investors make—and unlike speculating on individual stocks or sitting on too much cash, it's a mistake that is a little harder to pin down.

When the market was at its most volatile earlier this year, ''investors did not run for the hills but they were making changes to their accounts,'' says Cory Clark, chief marketing officer of Dalbar, which found that nearly a third of investors working with traditional or robo-advisors reallocated their assets during the Covid market crisis.

- Barron's

- |

- 12/13/2020

- Go To Article

Dalbar Study Signals Bright Future For Robos

The Covid-19 market crisis was the first big test for robo-advisors, and judging from a Dalbar study comparing insights between investors with robo-advisors to those with traditional financial advisors, they scored more than a passing grade.

Investors between the ages of 31 to 45 had the greatest satisfaction with their advisor. That represented 46% of traditional investors and 69% robo-investors. Traditional investors ages 46 to 75 had relatively low satisfaction ratings with their advisor, according to the Investor Insights: COVID-19 and Robo-Advice study.

- FA Magazine

- |

- 12/1/2020

- Go To Article

Robos Slightly Outperformed Human Advisors in Client Satisfaction During Crisis: Report

Robo-advisors seem to have passed their first big test with flying colors.

Dalbar, an investment research firm, reported recently that 82% of investors it surveyed were satisfied with their robo-advisor during the market crisis brought on by the pandemic earlier this year. This compared with 71% of investors using an advisor.

- ThinkAdvisor

- |

- 11/30/2020

- Go To Article

Investors Less Likely to Heed Advice from Robo Advisers

In ''COVID-19 and Robo Advice'', a report from Dalbar, the research firm surveyed 500 investors who had worked with a human adviser and 495 who had worked with a robo adviser this year, and found many investors are more comfortable with human advisers.

Robo investors were generally less likely to follow the recommendation of their adviser than traditional investors. The only recommendation that robo investors were more likely to follow was to invest more (71% versus 68%).

- PlanAdvisor

- |

- 11/24/2020

- Go To Article

New Dalbar Offering Aimed at Helping Advisors Improve Investor Behavior

Dalbar has launched a new subscription-based interactive hub for advisors to communicate with clients to support and improve investor behavior.

The platform, known as QAIB Advisor Studio, is available for $250 a year for advisors (it varies for enterprise subscriptions), and is based on Dalbar's proprietary Quantitative Analysis of Investor Behavior. It will be updated throughout the year.

- ThinkAdvisor

- |

- 10/29/2020

- Go To Article

Advisors Get an 'A' From Investors on Pandemic Response: Survey

In August, Dalbar, an investment research firm, surveyed 995 investors in North America who had a relationship with a financial advisor, presenting them with questions about their experiences with investing, the markets and their advisor during the coronavirus market crisis and months that followed.

- ThinkAdvisor

- |

- 10/23/2020

- Go To Article

Investors more confident in advisors after Covid downturn: report

Following the Covid-19-related market crisis of 2020, investors with advisors seem more confident in their portfolios and professional financial relationships.

- Investment Executive

- |

- 10/22/2020

- Go To Article

Banks Are More Dangerous than You Think, Report Says

Teller windows and ATMs could use a good scrubbing with Purell, according to the results of secret inspections of 500 bank branches in the U.S. and Canada.

Secret shoppers sent to spy on bank branches saw just 7% of ATMs being cleaned. Greeters at branch doors wore masks 44% of the time, and only 19% of teller areas were cleaned between customers.

- Forbes

- |

- 9/18/2020

- Go To Article

Mystery shoppers reveal that banks are struggling with COVID-19 response

A recent study examined the response of the 15 leading North American banks to the COVID-19 pandemic. Researchers discovered that tellers only at three banks wore masks 100% of the time.

Participants visited 700 bank branches across the continent belonging to leading institutions, such as Bank of America, Chase, Citibank and TD Bank. Overall, these 15 banks operate over 33,000 branches.

- Cointelegraph

- |

- 9/18/2020

- Go To Article

Active Fund Managers, and Women, Are the Stars of the Coronavirus Market Crisis

After years of lagging behind index funds, active managers have long stressed that they would show their worth when volatility hit. Now it has, as the coronavirus has roiled markets.

It is still too early for anyone to say ''I told you so,'' but a quantitative study of investors' behavior during the first half of this year by the financial research firm Dalbar may give defenders of active management some ammunition.

- Barron's

- |

- 9/1/2020

- Go To Article

Active Equity Investors Outperform Market And S&P 500 In 2Q

Active equity fund investors outperformed equity index fund investors and the S&P 500 in the second quarter, and they also withdrew less assets than their peers, according to a Dalbar analysis released today. The cash flow pattern in the second quarter broke an eight-year trend, the firm said.

''The average active equity fund investor outperformed the average equity index fund investor by 223 bps in the second quarter (20.97% for active versus 18.74% for index),'' the Massachusetts-based financial date company reported.

- FA Magazine

- |

- 8/31/2020

- Go To Article

Active Equity Fund Investors Beat Indexers in Q2: Dalbar

The second quarter was not only an exceptionally strong one for U.S. stocks but also an especially strong quarter for investors of actively managed equity funds.

According to a new Dalbar study that focuses on investor behavior rather than market or fund returns, the average active equity fund investor outperformed the average equity index fund investor by 223 basis points in the second quarter — gaining 20.97% versus 18.74%.

- ThinkAdvisor

- |

- 8/31/2020

- Go To Article

DALBAR to DOL: A Rollover Decision Is Not an Investment Decision

Dalbar has told the Employee Benefits Security Administration that EBSA has based proposed sales standards for 401(k) plan rollovers on a faulty premise: that rollover decisions are investment decisions..

''Rollover decisions are primarily driven by spending choices, personal obligations, estate considerations and longevity risk,'' Dalbar says, in an outline of Dalbar executives' views that was sent to EBSA. ''Only after the rollover decision is made can attention be turned to the investment decisions.''

- ThinkAdvisor

- |

- 8/31/2020

- Go To Article

Flows into active funds outpace passive funds for the first time in eight years

Investors in actively managed equity funds fared better than investors in passive equity funds in the second quarter — and even outperformed the S&P 500, according to a new report.

The report, published by Marlborough, Mass-based DALBAR, Inc., found that the average active equity fund investor contributed assets in April, May and June while the average equity index fund investor withdrew assets during each of those months.

- Advisor's Edge

- |

- 8/31/2020

- Go To Article

DALBAR Warns of Hidden Burdens Related to Rollovers in New DOL Rule

Could the Department of Labor have underestimated the compliance costs that would be associated with its proposed regulation related to rollovers from employer-sponsored retirement plans?

Independent third-party expert in providing evaluations, ratings, and due diligence DALBAR Inc., thinks so, and in addition to letting the DOL know about it with a July comment letter, has now gone a step further.

- 401(k) Specialist

- |

- 8/20/2020

- Go To Article

Dalbar Slams DOL's Proposed ESG Rule, Saying It Hurts Plan Participation

The U.S. Department of Labor gravely erred in its proposal to limit ESG investing, which will hurt both participation levels and contributions in retirement plans, Massachusetts-based ratings giant Dalbar said in a comment letter.

All evidence indicates employees want environment, social and governance (ESG) investments in their plans. If the DOL tries choosing the investments employees can select, it ultimately will dictate how many employees participate in a workplace plan and how much they contribute, the company argued. ''For over 25 years, Dalbar's research has shown that behavior has the greatest impact on an investor's long-term outcome,'' the company's chief marketing officer Cory Clark said in a statement.

- FA Magazine

- |

- 8/6/2020

- Go To Article

DOL's ESG Proposal Blasted by Commenters

The Department of Labor's proposed rule addressing environmental, social and governance (ESG) factors in selecting plan investments received more than 1,500 comment letters during the 30-day comment window, with many taking issue with the proposal.

The proposed regulation was released June 23, but the comment period ended July 30. Among the commenters were law, investment and advisory firms, industry trade groups, pension groups, private sector companies, members of Congress and individuals, with many offering substantive comments or suggesting that the department extend the comment period or withdraw the proposal and start over.

- NAPA

- |

- 8/5/2020

- Go To Article

Opinion: Bond blowout outwits investors

Once upon a time John and Jane Public were terrible at timing the stock market. They sold stocks at the wrong time, bought them back at the wrong time, and ended up doing worse than someone who just owned the overall S&P 500 SPX, -0.07% and forgot about it. But this year, John and Jane have made a big advance. No longer are they bad just at timing the stock market. Now they’re bad at timing the bond market, as well.

- MarketWatch

- |

- 6/18/2020

- Go To Article

Fixed-Income, Target-Date Fund Investors Most Aggressive With Q1 Withdrawals

Investors in what have historically been the most conservative mutual fund asset classes were actually the most spooked into making withdrawals during the first quarter’s Covid-related market volatility, according to new research from Dalbar.

- FA Magazine

- |

- 5/19/2020

- Go To Article

Should Investors have FOMO?

Nobody knows if we have reached the turning point in the year's pandemic-induced market meltdown. The markets are not quite as scary as they were at the beginning of March when some markets lost nearly 20% of their value in a single day.

Some recoveries are rather swift, while others take a little more time, but there is one way to know when the market has reached its bottom … just kidding .... there is no way of knowing, and that's exactly why the average investor should not be bailing out of their positions when storm seas get rough.

- Financial Independence Hub

- |

- 4/20/2020

- Go To Article

Staying Steady in a Bear Market

Financial journalists tend to only write about and discuss what to do in a bear market once the bear market has begun. People are usually reactive, rather than proactive, when it comes to investing. When stocks go up, they buy more. When stocks go down, they sell. This childish behavior accounts for the dramatic differences between investor returns and investment returns extensively documented by firms such as Dalbar and Morningstar. Buying high and selling low is an all too frequently experienced investment disaster.

- The Physician Philosopher

- |

- 3/21/2020

- Go To Article

Rocky Balboa offers insights on handling volatile markets

Rocky Balboa said, ''You, me, or nobody is gonna hit as hard as life. But it ain't about how hard ya hit. It's about how hard you can get hit and keep moving forward. How much you can take and keep moving forward. That's how winning is done.'' Investors are getting hit hard. The broad US equity market, as represented by the S&P 500 Index, experienced a 30% bear market decline in the course of 23 trading days.1 That's roughly 130 days faster than the typical bear market, dating back to 1900.2 The massive gains of 2019 disappeared between Valentine's Day and St. Patrick's Day.3 The instinct is to sell. Sit the rest of this out. Yet, we can't stop thinking about all we have learned of the follies of trying to time the market. We summon up the famous DALBAR study, and the analysis showing what happens if we miss the best days in the market (half of those days happen during a bear market4)

- George Matthews

- |

- 3/20/2020

- Go To Article

Market Timing: More Evidence Why It Doesn't Work

By its very nature, investing in stocks -- both in the U.S. and internationally -- courts a certain amount of portfolio volatility. Trying to make buy or sell decisions based on short-term fluctuations, however, can create an extremely uncomfortable investment experience over time. Of late, major financial publications across the country have been warning of severe repercussions for investors after an outset of coronavirus cases. In such a Jekyll and Hyde period, stock prices dropped. The next moment, values went up. The one constant: markets twisted and turned, churning at a seemingly dizzying pace.

- Index Fund Advisors

- |

- 3/5/2020

- Go To Article

The Asset Allocator: Dalbar Rethinks Asset Allocation (Podcast)

New Dalbar research takes a look at asset protection strategies through the prism of opportunity cost, with a view toward lowering investors’ hedging costs or even increasing their total returns. This podcast (8:10) suggests that Dalbar’s alternative allocation findings are quite helpful, so long as advisors do the appropriate due diligence for their clients, but also proposes another strategy for Dalbar’s quants to test empirically.

- Seeking Alpha

- |

- 3/4/2020

- Go To Article

Investors, don't be lemmings. The time to sell stocks isn't when everyone else is

The time to sell is not when stocks are down. Yet the principle is so much easier to embrace during rising markets than in the midst of chaotic selling, which causes our flight instinct to kick in. Resist the urge. Money is made at turning points, and the crowd is rarely right at critical moments. Why? Because 50% to 90% of daily volume is driven by the trading algorithms, not by human investors with long-term time horizons.

- USA Today

- |

- 3/2/2020

- Go To Article

The Costliest Mistake Investors Must Avoid in 2020

There are numerous ways investors can lose their hard-earned money in the stock market.

- performance chasing

- buying yield traps whose dividends are unsustainable and likely to be cut, possibly several times

- grossly overpaying for quality companies to the extent that even if they grow as expected you might see negative returns for years or even decades

- ignoring deteriorating fundamentals (thesis breaks about 20% of the time even if you perform proper due diligence)

- Stock News

- |

- 1/10/2020

- Go To Article

The Asset Allocator: Dalbar's Investor Panic-Relief Tool (Podcast)

For a quarter of a century, Dalbar has highlighted the problem of poor investor performance, fueled by return-chasing and panic selling; now it is offering a practical solution it calls I-PRT (Investor Panic Relief Tool). This podcast (7:15) explains that Dalbar’s solution is not to prepare investors ahead of time with education that doesn’t work, but rather to prepare the advisor ahead of time with a tool that could tilt the scales of the “fight or flight” reaction toward “fight.”

- Seeking Alpha

- |

- 12/3/2019

- Go To Article

Avoiding the Cost of Panic

Investors lose massive amounts due to panic selling in down markets. More can be done about this perennial problem. This article identifies one critical action that can be taken to stem panic-driven losses. That action is based on a full understanding of the timing, cause and prudent use of financial instruments that can avoid much of the loss.

- Advisor Perspectives

- |

- 12/2/2019

- Go To Article

Selling a Market Darling

Statistically, you and I are terrible investors...

This unfortunate reality is the takeaway of research done by Dalbar Inc., a company that studies investor behavior and their market returns.

What Dalbar has found is that the average investor woefully underperforms the broad market.

- InvestorPlace

- |

- 10/1/2019

- Go To Article

Edelman Financial Engines is bringing financial planners to small 401(k) plans

Edelman Financial Engines is bringing financial planning to participants in small 401(k) plans over the next six months as the advisory firm emerges from its recent integration and seeks to expand distribution. The firm will leverage a recently forged relationship with 401(k) administrator ADP, which caters primarily to smaller-sized workplace retirement plans, to pair financial planners with 401(k) investors.

- Investment News

- |

- 9/20/2019

- Go To Article

Your Funds: If complex solutions confuse you, stay put in scary markets

The most simplistic advice is often the best, and there’s little that is simpler or better than “Stay invested.” Countless studies have shown that investors have terrible timing, awful instincts and, accordingly, bad results. The landmark Quantitative Analysis of Investor Behavior from Dalbar Inc. has measured investment results compared to the stock market for a quarter-century, and it has repeatedly proved that investments do better than investors.

- Richmond Times-Dispatch

- |

- 9/20/2019

- Go To Article

Money Life with Chuck Jaffe: Use the rate cuts to change your personal finances before it's too late (Podcast)

Lou Harvey from DALBAR Inc. discusses a strategy that should help investors stay put, literally, in the next market downturn.

- Money Life with Chuck Jaffe

- |

- 9/17/2019

- Go To Article

The Asset Allocator: Dalbar's Louis Harvey On What Drives Investors To Lose Money (Podcast)

Investment consultancy Dalbar’s latest research suggests that it is a mistake for advisors to assume that investors have a static risk tolerance. To the contrary, it changes constantly – on the basis of both market conditions and the client’s constantly shifting personal status. In this podcast interview (14:07), Dalbar’s Louis Harvey suggests that advisors need to constantly assess and re-assess their clients' risk tolerance, and engage in behavioral coaching accompanying a tolerable asset allocation.

- Seeking Alpha

- |

- 8/7/2019

- Go To Article

The Asset Allocator: Of Models And Marketing (Podcast)

This podcast (6:33) relates some examples of adulated investors who turned out to be in the main great marketers, and draws attention to a hard-to-market investment with which many investors have actually succeeded. The moral of the story is for advisors to focus firmly on keeping their clients invested for long-term success. Incidentally, a Dalbar study shows that a particularly hated model has been more helpful to investors than models that are more successfully marketed.

- Seeking Alpha

- |

- 8/1/2019

- Go To Article

You’re making big financial mistakes – and it’s your brain’s fault

Since 1988, the stock market’s average return has been 10% per year. But stock fund investors have earned only 4.1% per year, according to Dalbar’s Quantitative Analysis of Investor Behavior.

- CNBC

- |

- 8/1/2019

- Go To Article

Investors Are Usually Wrong. I’m One of Them.

Forget about getting everything right. Most people are so consistently wrong that merely avoiding major errors is enough to set you apart from the pack.

That is the message in the latest data from Dalbar, a Massachusetts research firm that has been studying the behavior of mutual fund investors for 25 years.

- The New York Times

- |

- 7/6/2019

- Go To Article

How to take advantage of all the uncertainty with the stock market

As the market soured in the final months of the year, investors pulled funds to mitigate losses, according to DALBAR's 2018 Investor Behavior Study, ...

- CNBC

- |

- 6/16/2019

- Go To Article

Why Your Investment Return May Differ From the Fund Company's Returns

The habit can be costly. Research firm Dalbar publishes an annual study of investor behavior, which tracks cash flows in and out of stock funds. In 2018, the average investor trailed Standard & Poor’s 500-stock index by 5.0 percentage points. (The S&P 500 lost 4.4% in 2018, which means the average investor lost 9.4%.) “Judging by the cash flows we saw, investors sensed danger in the markets and decreased their exposure, but not nearly enough to prevent serious losses,” says Dalbar’s Cory Clark.

- Kiplinger

- |

- 5/17/2019

- Go To Article

Investors Attempt To “Time” The Market And Lose Money

If you want to be an investor, don’t be an average one. It can very well be a ridiculous proposition. The individual investors on an average would make mistakes, just like they did last year and this is evident from the report that was published in the latest report of Dalbar, the financial research company.

- Market News World

- |

- 5/10/2019

- Go To Article

Investors are losing thousands trying to 'time' the market

Dalbar also found that over a 30-year period it gets worse — the average investor loses almost 6 percent a year compared with the market's return.

- NY Post

- |

- 5/5/2019

- Go To Article

The signal for avoiding market’s next painful downturn comes from within

...But after reading my column last week about the Dalbar Quantitative Analysis of Investor Behavior study showing just how lousy investor timing was in 2018, he wanted help to improve his timing...

- The Seatle Times

- |

- 4/20/2019

- Go To Article

WEALTH HEALTH: Investors failed the downturn test of 2018

The latest Quantitative Analysis of Investor Behavior study from Dalbar Inc. showed that average investors lagged the Standard & Poor’s 500 Index both in good times and bad during 2018, but investors got it the most wrong late in the year when the market got ugly.

Dalbar’s study, which has measured investment results compared to the market for a quarter-century now, has long shown that investments do better than investors. The problem is that investors typically buy into stocks and funds only after there has been a run of good performance and bail out when they suffer declines.

- Wicked Local

- |

- 4/12/2019

- Go To Article

What Happens When You Miss the Best Days in the Stock Market?

...Investment research firm Dalbar publishes an annual survey of the average investor's performance versus the benchmark. Dalbar studied retail equity and fixed-income mutual fund flows (money in and out of the fund) each month from Dec. 31, 1997 to Dec. 31, 2017 to calculate the "average investor" return. The average investor performed below average when compared to buying and holding the S&P 500 index...

- Nasdaq

- |

- 4/11/2019

- Go To Article

Wealth Matters: Stock market ‘guru’ same as ‘charlatan’

We are all influenced by our emotions, our hopes and fears. Such is being human. But these emotions do not always lead to the best decisions. When you add our attitudes about money to the mix, the results can be quite complicated.

- Daily Republic

- |

- 4/8/2019

- Go To Article

Investors Bailed Out of Stock in 2018 and Got Double-Slammed

The average investor fled from the stock market and ended up losing twice what the S&P 500 did, Dalbar says.

They did it again. The average investor took money out of the stock market in 2018, a year that suffered from two painful corrections. And their investment performance was worse than the market’s, according to a survey by research firm Dalbar.

- Chief Investment Officer

- |

- 4/5/2019

- Go To Article

Opinion: Investors’ widely-held beliefs about ETFs and index funds may be wrong

Low-cost funds may be fixing the wrong problem, new data suggest

A new study has just shaken one of the biggest investment myths on Main Street.

An analysis of mutual fund stock trades over the past two decades has thrown into question the rationale that has sent everybody and her grandmother stampeding into low-cost index funds and exchange traded funds.

- MarketWatch

- |

- 4/3/2019

- Go To Article

DALBAR: U.S. Investors Lost Twice As Much As The S&P 500 In 2018

A combination of volatile market conditions and bad timing caused the average U.S. investor to lose twice as much as the S&P 500 in 2018, according to a new study from DALBAR.

The research firm’s latest Quantitative Analysis of Investor Behavior (QAIB) found that investors were actually blown away by market turmoil last year, losing 9.42 percent over the course of 2018, compared with a 4.38 percent retreat by the S&P.

- FA-Mag.com

- |

- 3/26/2019

- Go To Article

Investors Doubled Their Stock Market Losses in 2018 By Making This Costly Mistake. Here's How to Avoid It

When investors panic, they can shoot themselves in the foot. New data suggests that’s what happened last year.

It’s no secret that 2018 was a wild year for investors in the stock market. The S&P 500 hit a record high by late September, before falling more than 7% in October and more than 9% in December.

- Money.com

- |

- 3/25/2019

- Go To Article

DALBAR study shows older women defy age and gender stereotypes when it comes to using technology to manage finances with paperless statements

Data from a recent DALBAR study that analyzed the interest in paperless statements, known as e-Delivery in the financial services industry, found that when it came to searching online for information about paperless statements, women across most age groups were more likely than men to be seeking out this service.

- Morningstar

- |

- 2/19/2019

- Go To Article

Is the Index Bubble About to Burst

“One reason for the disparity (of underperformance) is that active managers don’t bet the ranch with your money,” said Boston-based DALBAR’s CEO Lou Harvey. “They hold some aside for the time when things go wrong. This protection takes away from gains, since a portion of your money is held in low-yielding cash and bonds.”

- FA-Mag.com

- |

- 2/5/2019

- Go To Article

Open MEPs could affect millions of retirement plan participants overnight

DALBAR’s Harvey: TPAs would benefit the most from Open MEPS among service providers.

The prospect of removing existing barriers to employer participation in Open Multiple Employer Plans could quickly impact millions of existing participants in small and midsized 401(k) plans.

- Benefits Pro

- |

- 9/5/2018

- Go To Article

To the Fiduciaries Go The Spoils

The word fiduciary has caused heartburn for most advisors. It is not the promise to act in clients’ best interest that scares most advisors; it is the task of proving that this was actually done that causes the pain. How is it possible to show that the motivation behind a recommendation is the client’s interest and not the compensation the advisor earns?

- ThinkAdvisor

- |

- 7/13/2018

- Go To Article

Complacency Is Weakest Cybersecurity Link: Dalbar/ThinkAdvisor Study

Despite the increasing fear Americans have of personal and financial information being stolen, most financial-services firms have been complacent on updating or implementing state of the art — or even basic — cybersecurity technology, according to a recent study by Dalbar/ThinkAdvisor entitled “The State of Authentication in Financial Services.”

- ThinkAdvisor

- |

- 4/4/2018

- Go To Article

How Scottrade Could Have Avoided DOL Rule Charges

Scottrade made a bet that the Labor Department's fiduciary rule wouldn't be enforced. It lost. But, for now, there's another way firms can keep their sales incentives.

- ThinkAdvisor

- |

- 2/23/2018

- Go To Article

Are Advisors’ Cyberdefenses Strong Enough? Dalbar-ThinkAdvisor Survey Seeks Answers

...“Authentication is now the primary defense, since the felons have already stolen the data,” said Lou Harvey, CEO of Dalbar, an independent financial-services market research firm, in an interview with ThinkAdvisor....

- ThinkAdvisor

- |

- 1/19/2018

- Go To Article

Statistics About Indexing's Advantage May Be Lying To You: Financial Advisors' Daily Digest

A new study by Dalbar finds that passive funds achieve higher returns, but active fund investors are better behaved and may actually come out ahead over the long term.

- Seeking Alpha

- |

- 2/28/2017

- Go To Article

Dalbar’s 12 Factors to Measure When Picking Active or Passive Funds

In the longer term, Dalbar says, active investments have produced better results, which reflects investors' tendency to stay in these funds for longer ...

- ThinkAdvisor

- |

- 2/23/2017

- Go To Article

Interview: Louis Harvey, Dalbar

Ary Rosenbaum, That 401(k) Guy, Interviews Louis Harvey

Q: How has the rollout of the new fiduciary rule impacted your business?

A: Firms seeking to comply under the new rules are taking advantage of Dalbar‘s services including Registered Fiduciary (RF™), Auditing required under ERISA 408(g), Computer Model Certification, Proof of Reasonableness of Compensation and Assessment of Rollover Practices. The fiduciary rule also creates new compliance burdens for the contact center. We have integrated fiduciary rule compliance into our evaluation criteria. This new element adds to the value proposition of our Service Quality Measurement Program. We look forward to continue helping contact centers grapple with the practical implications of the rule...

- That401kSite.com

- |

- 11/28/2016

- Go To Article

Why Trump Will Not Cancel the Fiduciary Rule

- Dalbar

- |

- 11/15/2016

- Go To Article

Dalbar Tool Aims to Limit DOL Rule’s Pay Cuts: Top Portfolio Products

Dalbar estimates that the average advisor could see a $34,000 reduction in compensation

- ThinkAdvisor

- |

- 11/14/2016

- Go To Article

Radio Interview: QAIB Study

Radio Interview: Cory Clark, Head of Research and Due Diligence at Dalbar discusses the QAIB study with Matt Kennedy of The Presley Group.

- YouTube

- |

- 8/1/2016

- Go To Article

DALBAR, 2016: Yes, You Still Suck At Investing (Tips For Advisors)

With the release of Dalbar's latest study, it would be prudent to both update, and remind you, of the problems investors continue to face despite the ...

- TalkMarkets

- |

- 6/6/2016

- Go To Article

DOL Fiduciary Rule is the new sheriff in town, Dalbar introduces solutions to new law of the land

Dalbar provides solutions to support whichever choices are selected so as to minimize risks, grow business and comply with the new “laws”.

- EconoTimes

- |

- 4/11/2016

- Go To Article

DALBAR's Harvey: DOL Fiduciary Rule's Cost to Brokers' Businesses

DALBAR's CEO Louis Harvey talks to ThinkAdvisor about how the rule will change brokers' day-to-day jobs — and how those who embrace their fiduciary duties can reap profits.

- ThinkAdvisor

- |

- 3/24/2016

- Go To Article

Even When Timing the Market Correctly, You Can Underperform

According to the Dalbar's 2015 Annual Quantitative Analysis of Investor Behavior (QAIB) the average equity fund investor correctly timed the market in ...

- TheStreet.com

- |

- 3/16/2016

- Go To Article

Amid Market Decline, Don't Sell Yourself Short

Each year Dalbar, a Boston-based consulting firm, examines how average investors perform relative to what they invest in. And without fail, each year ...

- Nasdaq

- |

- 2/19/2016

- Go To Article

McBride: Consider options carefully if you come into unexpected money

A widely cited study, called Dalbar's Quantitative Analysis of Investor Behaviour, compares investors' average annual returns to market returns.

- Saskatoon StarPhoenix

- |

- 1/25/2016

- Go To Article

Tools, Training to Address DOL Fiduciary Definition

It's not yet a done deal, but Dalbar expects the best interest contract (BIC) exemption in the proposed fiduciary definition by the Department of Labor ...

- Planadviser.com

- |

- 1/12/2016

- Go To Article

Want To Avoid Losing Money In Stocks? Do These 5 Things

Investing research outfit Dalbar has been publishing a series of reports for years now which include a comparison of U.S. stock market investors' ...

- The Motley Fool Singapore

- |

- 12/22/2015

- Go To Article

Investors should fear themselves

The oft-cited annual report by Boston firm Dalbar into average investor returns would indicate that a good financial adviser can significantly boost ...

- Irish Times

- |

- 11/24/2015

- Go To Article

Don't Let Stock Market Scares Dictate Your Strategy

Schmansky's observation is backed by some sobering numbers from research firm Dalbar, which since 1984 has studied the effects of mutual fund ...

- TIME

- |

- 11/9/2015

- Go To Article

We have met the enemy (of our portfolio) and he is us

Each year Dalbar updates its annual "Quantitative Analysis of Investor Behavior" report. The 2015 update reveals that over the most recent 20 year ...

- Monroe News Star

- |

- 11/8/2015

- Go To Article

The Most Important Chart Investors Have to See in the Bear Market Now

...Dalbar, the investing research outfit that came up with the data used in the chart, attributes the phenomenon to investors’ propensity to buy and sell their investments at the wrong times...

- The Motley Fool

- |

- 9/30/2015

- Go To Article

Lou Harvey: Looking for Mr. Dalbar—The 2015 IA 35 for 35

The wizard behind the curtain of the ubiquitous research firm helped popularize behavioral finance and keeps the industry on top of important issues.

- ThinkAdvisor

- |

- 5/14/2015

- Go To Article

Lou Harvey honored as a top leader by Investment Advisor magazine!

The 2015 IA 35 for 35 - Lou Harvey honored as a top leader by Investment Advisor magazine! ...

- ThinkAdvisor

- |

- 5/4/2015

- Go To Article

The No. 1 Mistake Investors Make

Financial data firm Dalbar annually updates its quantitative analysis of investor behavior study, which shows how the average fund investor performed ...

- Motley Fool

- |

- 10/24/2014

- Go To Article

Dalbar Grants AXIS Retirement Analytics Platform Its Benchmark Methodology Certification Seal

Dalbar, a trusted source for helping the retirement industry in achieving excellence through evaluation and accreditation of strict processes has ..

- Insurance News Net

- |

- 9/9/2014

- Go To Article

Average Investors Have No Rhythm

A company named Dalbar sells an annual study of investor behavior and relative investment returns to financial advisors. The chart below has been ...

- Seeking Alpha

- |

- 8/31/2014

- Go To Article

Why Is the Investor's Personal Rate of Return Missing on Financial Statements?

Only 25% of statements across the annuity, mutual fund, and brokerage sectors include a "personal rate of return," Dalbar's annual survey says.

- Wall Street & Technology

- |

- 7/18/2014

- Go To Article

Investment Firms Try to Find Their Social Media Groove

A recent ranking by research firm Dalbar reveals how Ameriprise, John Hancock, New York Life and Prudential have created winning social media campaigns...

- Institutional Investor

- |

- 6/13/2014

- Go To Article

Investment Firms Try to Find their Social Media Groove

A recent ranking by research firm Dalbar reveals how Ameriprise, John Hancock, New York Life and Prudential have created winning social media campaigns.

- Institutional Investor

- |

- 6/13/2014

- Go To Article

American IRA-A National Self-Directed IRA Provider-Announces The New Quantitative Analysis Of Investor Behavior Study Shows Mutual Funds Underperformed by 7.4% per year.

According to Dalbar's data, the average investor in mutual funds trailed the index over the trailing 12 month, 3 year, 5 year and 10 year time period.

- Intercooler

- |

- 5/20/2014

- Go To Article

6 Top Mobile Websites for Investors: Dalbar

That's why Boston-based research firm Dalbar rated 48 financial services company apps, according to 11 distinct evaluation categories including ...

- ThinkAdvisor

- |

- 5/19/2014

- Go To Article

How to Avoid the Number 1 Mistake Investors Make

The latest research from Dalbar not only confirms this, but reveals the gap to be especially wide. Over the past 30 years, the S&P 500 has returned ...

- Motley Fool Canada

- |

- 5/16/2014

- Go To Article